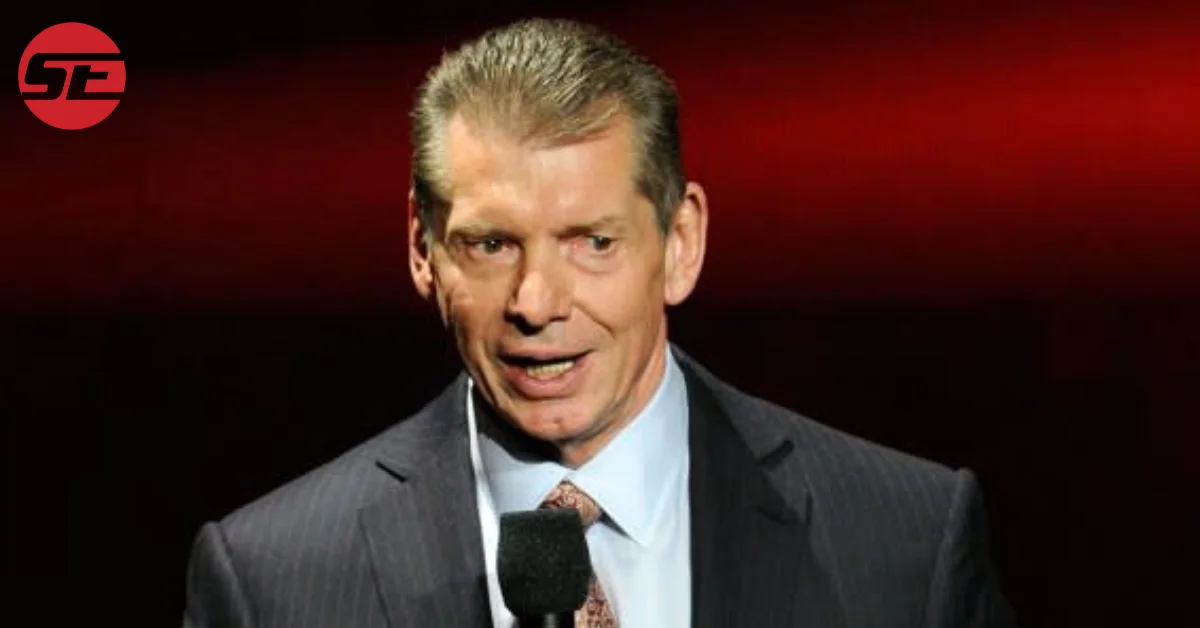

Vince McMahon’s Major Stock Sale

Vince McMahon, the influential former CEO of WWE, has taken a significant step by selling a substantial portion of his shares in TKO Group Holdings. This move comes after the merger of WWE and UFC, a deal orchestrated by Endeavor, the parent company of UFC.

“McMahon, the former CEO of WWE, intends to sell 8.4 million shares of Class A common stock in TKO Group Holdings.”

Priced at $79.80 per share, the sale amounts to a staggering $670.3 million, marking a notable transition in McMahon’s involvement with the company.

Details of the Stock Sale

Early on Friday, TKO Group Holdings announced the pricing of McMahon’s shares. This sale represents approximately 30% of the 28 million shares McMahon owned in TKO. The financial significance of this transaction is immense, with McMahon set to receive all net proceeds.

“Early Friday, TKO announced McMahon’s shares would be priced at $79.80 per share, making the stock sale worth $670.3 million.”

TKO Group also plans to repurchase about $100 million of its Class A common stock from the underwriters in McMahon’s stock sale.

Vince McMahon’s Role and Past Controversies

Despite stepping down as WWE’s chief executive in 2022 amid allegations of sexual misconduct, McMahon returned to the company in January 2023 as executive chairman to oversee the sale of WWE. He owned 16.4% of the economic interest in TKO when the deal was finalized.

“McMahon stepped down as WWE’s chief executive in 2022… McMahon returned to the company in January 2023 as executive chairman.”

His role in TKO Group, coupled with past controversies, makes this stock sale a significant event in the business world of sports entertainment.

Executives Investing in TKO Stock

Following McMahon’s stock sale, notable figures like Ariel Emanuel, TKO’s CEO, and Mark Shapiro, president and COO, each purchased $1 million in TKO stock. Other directors of the company also invested in the stock, indicating confidence in the newly formed entity.

“Ariel Emanuel, TKO’s CEO and director… and Mark Shapiro, president, COO and director… both purchased $1 million in TKO stock.”

These investments by high-ranking executives underscore the strategic moves being made within TKO Group Holdings.

TKO Group Holdings’ Financial Performance

TKO Group Holdings recently reported its third-quarter earnings, showcasing mixed results. The company saw a rise in revenue and adjusted earnings, but a decline in net income compared to the previous year.

“The company reported revenue of $449.1 million, up 32% from the year-ago quarter, and adjusted earnings before interest, taxes, depreciation and amortization up 26% to $239.7 million.”

These figures represent TKO’s financial health post-merger, offering insights into its current market standing.

Leadership and Bonus Payouts Post-Merger

With the formation of TKO, Dana White remains the CEO of UFC, and Nick Khan continues as WWE president with a seat on TKO’s board. The merger also resulted in significant “sale bonus” cash payments to various WWE executives.

“Dana White is now CEO of UFC and Nick Khan continues at WWE in the role of president… WWE execs who received ‘sale bonus’ cash payments in connection with the TKO deal included Khan ($15 million)…”

These leadership positions and bonuses reflect the restructuring and rewards associated with the merger.

The Business Shifts in TKO Group Post WWE-UFC Merger

In conclusion, Vince McMahon’s substantial stock sale in TKO Group Holdings represents a significant shift in the sports entertainment industry following the WWE-UFC merger. This move, coupled with investments by other executives and the company’s financial performance, highlights the evolving landscape of the business. As TKO navigates its newly merged status, the actions of its key players like McMahon, Emanuel, and others will continue to shape the future of this entertainment powerhouse.